Parmi la multitude d’options de jeu accessibles aujourd’hui, Bwin Casino se distingue comme un modèle de fiabilité et d’honnêteté en France. Grâce à sa licence accréditée et à sa régulation rigoureuse, nous pouvons analyser comment cette plateforme favorise la sécurité des joueurs et l’équité du jeu. En examinant les aspects de son offre, il est important de saisir ce qui distingue véritablement Bwin dans ce paysage concurrentiel. Qu’est-ce qui en fait le sélection privilégié de nombreux joueurs ?

Points essentiels à se rappeler

- Bwin Casino est autorisé par des organismes de jeux renommées, garantissant ainsi le conformité des règles en matière de clarté et d’justice des méthodes de jeu en France.

- La site emploie des technologies de cryptage de données avancées pour sécuriser les informations des joueurs et garantir une expérience de jeu sécurisée.

- Des audits fréquents effectués par des entités tiers valident les issues des jeux, encourageant ainsi l’honnêteté et la confiance entre les joueurs.

- Bwin Casino encourage proactivement les pratiques de jeu raisonnable, notamment par le moyen de restrictions de dépôt et d’options d’auto-exclusion, en privilégiant le santé des joueurs.

- Les ressources pédagogiques et les collaborations avec des entités de soutien aident les joueurs à comprendre et à gérer efficacement les dangers liés au jeu.

Présentation du casino Bwin

Bwin Casino s’impose comme un joueur important du domaine des jeux en ligne français, offrant une sélection étendue de jeux. Son approche créative des promotions, qui fidélise les joueurs et augmente leur expérience, est notable. Grâce à des offres et des prix séduisants, l’atmosphère de jeu reste dynamique et rivalisante. De plus, son implication envers le jeu mobile est un avantage important : sa plateforme est conçue pour une utilisation sans heurts sur smartphones et tablettes. Ainsi, chacun peut jouir de ses jeux préférés où et quand il le souhaite, un avantage crucial dans le monde actuel. En se focalisant sur l’accessibilité et l’engagement des utilisateurs, Bwin Casino comble aux exigences des joueurs les plus difficiles et s’affirme comme une référence sur le marché des jeux en ligne.

Licences et réglementation

Lorsqu’on examine l’univers des casinos en ligne, il est crucial de prendre en compte les licences et la réglementation qui régissent leur fonctionnement. Chez Bwin Casino, nous savons que le adhésion des instances de jeux habilitées est capital. Cela établit un environnement juridique robuste, garantissant des pratiques transparentes et sauvegardant les intérêts des joueurs. Ces organismes, mandatées de superviser et de enforcer la réglementation, jouent un fonction crucial dans le maintien de l’intégrité de l’expérience de jeu. Elles s’assurent à ce que tous les composants opérationnels suivent des critères strictes, des échanges financières à la sécurité des informations clients. En adhérant à ces règles, Bwin Casino renforce non seulement sa notoriété, mais aussi la crédibilité de ses joueurs. Dans cet cadre contrôlé, nous pouvons promettre à nos utilisateurs une aventure de jeu fiable et impartiale, exigence nécessaire pour prospérer dans les jeux en ligne.

Sélection et variété des jeux

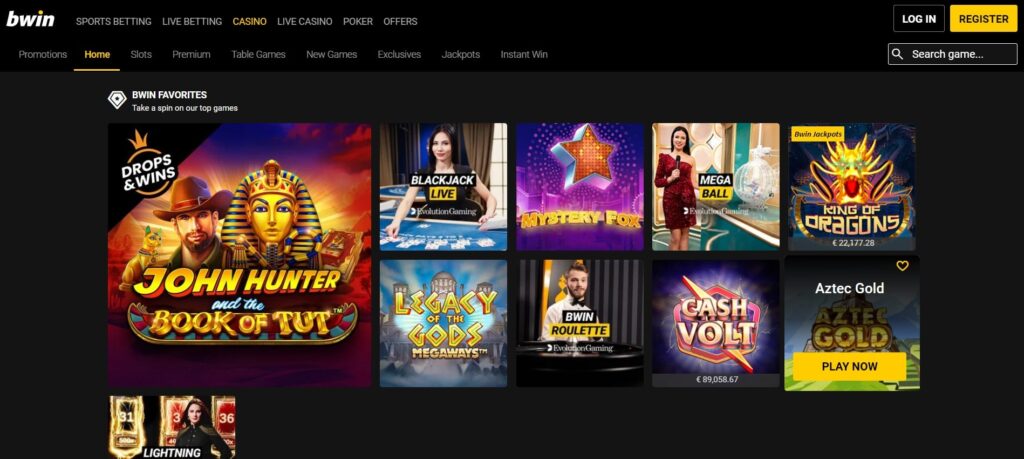

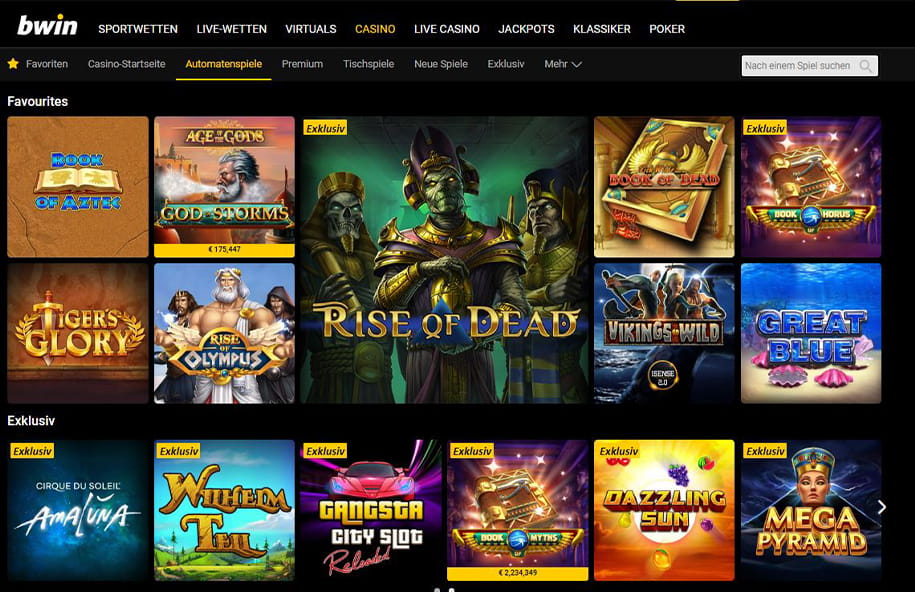

Chez Bwin Casino, nous aimons la étendue gamme de jeux de table qui sont adaptés à tous les niveaux et à chaque préférence. De plus, la diversité de machines à sous nous présente d’innombrables thèmes et mécanismes à découvrir. Ensemble, ces options améliorent notre expérience de jeu et nous captivent.

Jeux de table variés

En découvrant la vaste gamme de jeux de table du casino Bwin en France, nous avons identifié une sélection attrayante qui augmente l’plaisir de jouer pour chaque joueur. La richesse des jeux témoigne non seulement de leur abondance, mais aussi de leur niveau, captivant aussi bien les débutants que les joueurs aguerris. Voici ce qui nous a particulièrement captivés :

- Blackjack

- Roulette

- Variantes de poker

Le casino Bwin nous promet de disposer des ressources essentiels pour contrôler efficacement nos options de jeu.

Machines à sous multiples

En explorant la large sélection de machines à sous du casino Bwin en France, on constate que sa diversité est l’un de ses principaux atouts. On y trouve un choix remarquable de thèmes, allant des machines à sous classiques à fruits aux machines à sous vidéo immersives inspirées de films et de mythologies célèbres. Ce catalogue complet répond aux préférences de chaque joueur et augmente l’expérience de jeu. De plus, nombre de ces machines proposent des jackpots innovants qui augmentent l’excitation et amplifient le potentiel de gains importants. En comprenant les fonctionnements et les thèmes disponibles, on peut choisir judicieusement les jeux auxquels jouer, améliorant ainsi ses chances de gagner et profitant pleinement de l’univers fascinant des machines à sous du casino Bwin.

Sécurité et jeu juste

Lorsqu’on considère l’importance de la protection et de l’équité dans les jeux d’argent en ligne, on constate que Bwin Casino en France attribue la priorité à ces facteurs afin de créer un environnement de jeu fiable. Cet dévouement consolide la confiance des joueurs. Pour comprendre comment ils garantissent la protection des joueurs et des pratiques équitables, on peut accentuer trois points clés :

- Chiffrement

- Conformité réglementaire

- Audits indépendants

Grâce à ces mesures, nous pouvons participer en toute assurance au casino Bwin, sachant que notre expérience de jeu est protégée et équitable.

Pratiques de jeu responsable

Chez Bwin Casino, le jeu responsable est au cœur de nos activités et témoigne de notre détermination envers le santé de nos joueurs. Nous sommes persuadés que le jeu responsable est crucial pour un environnement de jeu équilibré. En mettant l’accent sur la sensibilisation, nous donnons aux joueurs les ressources de prendre des choix informées qui enrichissent leur expérience.

Bwin Casino met en œuvre de nombreux moyens et ressources, tels que des plafonds de dépôt, des possibilités d’auto-exclusion et des procédures de validation de l’âge, afin de limiter les dangers liés au jeu compulsif. Nous offrons également des supports didactiques pour favoriser la appréhension des bases du jeu responsable.

De plus, nous partenariats avec des associations qui soutiennent les joueurs face à des troubles de jeu, afin de assurer un accès facile à l’aide. Notre engagement en matière de confiance nous permet d’établir un environnement de assurance et de promouvoir une collectivité de joueurs durable où le divertissement domine.

Assistance clientèle et expérience utilisateur

Bwin Casino offre un réseau d’assistance clientèle efficace, élaboré pour améliorer l’expérience utilisateur de tous les joueurs. Son engagement à fournir une aide réactive se exprime par plusieurs aspects importants :

- Multiples voies de communication

- FAQ exhaustive

Cet investissement en matière de soutien démontre de la détermination de Bwin d’offrir une expérience utilisateur remarquable, en favorisant un cadre de confiance pour tous les joueurs recherchant des jeux de hasard légaux en France.

En Conclusion

Dans l’univers du gaming en ligne, bwincasinos.eu, Bwin Casino fait figure de phare, guidant les participants vers une aventure sécurisée et divertissante. Sa licence solide et son engagement en faveur du gaming responsable sont autant d’ancres fiables, nous assurant une annualreports.com traversée paisible au cœur des incertitudes du jeu. Grâce à une gamme diversifiée de jeux et à un service client irréprochable, nous sommes en mesure de profiter pleinement de l’excitation en toute tranquillité, ayant l’assurance que nos intérêts sont protégés. Continuons d’explorer cette plateforme de confiance, où chaque tour et chaque transaction repose sur l’intégrité et la sécurité.