Understanding Forex Trading Options: A Comprehensive Guide

Forex trading options are a powerful financial instrument that enables traders to manage risk and leverage their positions in the foreign exchange market. By utilizing forex trading options Trading Brokers in Qatar, traders can access various tools and resources designed to enhance their trading experience.

What are Forex Trading Options?

Forex trading options give the buyer the right—but not the obligation—to buy or sell a specific amount of a currency pair at a predetermined price (known as the strike price) before or on a specified expiration date. Options can be classified into two main types: call options and put options. A call option gives the holder the right to buy a currency pair, while a put option grants the right to sell.

Benefits of Forex Trading Options

There are several advantages to trading options in the Forex market, including:

- Flexibility: Options can be structured in various ways to suit a trader’s risk tolerance and market view.

- Leverage: Options allow traders to control larger positions with a smaller amount of capital, increasing potential returns.

- Risk Management: Options can be used to hedge against adverse movements in exchange rates, protecting existing positions.

- Strategic Opportunities: Traders can implement various strategies, such as spreads and straddles, to profit from market movements.

How Forex Options Work

To better understand how Forex trading options work, it’s essential to comprehend the key components involved:

- Premium: The price paid to purchase the option, which is a percentage of the notional value of the contract.

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date by which the option must be exercised or will expire worthless.

- Underlying Asset: In Forex options, the underlying asset is the currency pair upon which the option is based.

Different Strategies for Trading Forex Options

Traders can utilize various strategies when trading Forex options, and choosing the right one can significantly impact their success:

1. Hedging

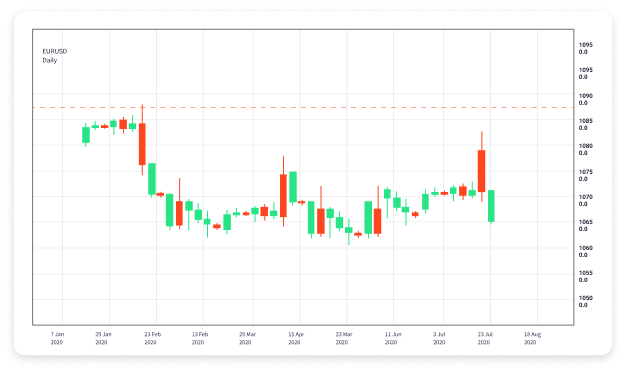

Hedging involves obtaining an option to guard against potential losses in an existing position. For example, if a trader holds a long position in EUR/USD, they could buy a put option to protect against a decline in the exchange rate.

2. Speculation

Speculators use options to bet on future price movements of currency pairs. By buying call or put options, traders can profit from expected shifts in the market without having to trade the currency pair directly.

3. Spread Strategies

Spread strategies, such as bull spreads and bear spreads, involve combining two or more options to capitalize on specific market movements while limiting potential losses. This approach can be particularly effective in volatile markets.

4. Straddles and Strangles

These strategies involve purchasing both a call and a put option on the same underlying asset, aiming to profit from significant movements in either direction. Straddles are executed at the same strike price, while strangles have different strike prices.

Risks Involved in Forex Options Trading

While Forex trading options can offer various benefits, they also come with inherent risks:

- Loss of Premium: If the market doesn’t move as anticipated, traders may lose the entire premium paid for the option.

- Limited Time: Options have expiration dates, and if the market does not move in the trader’s favor before expiration, the option may become worthless.

- Complexity: Options trading can be complex and may not be suitable for all investors, particularly those unfamiliar with the mechanics of options contracts.

Choosing a Forex Options Broker

Selecting the right broker is crucial for successful Forex options trading. Here are important factors to consider:

- Regulation: Ensure the broker is licensed and regulated by a reputable authority.

- Trading Platform: Evaluate the broker’s trading platform for usability and features tailored to options trading.

- Fees and Commissions: Consider the differential pricing structure, including commissions and spreads, which can impact profitability.

- Educational Resources: A good broker provides resources like webinars, articles, and charts to help traders make informed decisions.

Conclusion

Forex trading options can provide traders with unique opportunities to exploit market movements and manage risk. By understanding how Forex options work and implementing the appropriate strategies, traders can enhance their potential for success. However, it’s essential to remain aware of the risks involved and choose a reliable broker to facilitate trading activities. With the right approach and education, Forex trading options can be a valuable addition to any trader’s toolkit.